Reviewing January’s home sales, it’s clearly a whole different market in western Nevada County than one year ago.

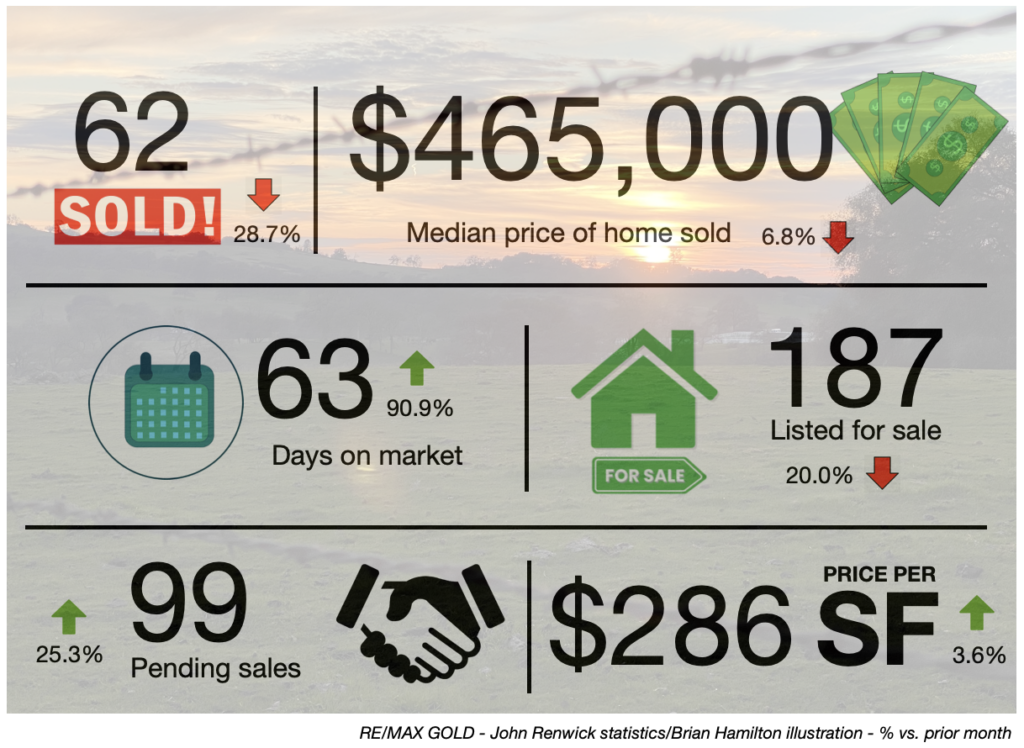

The 62 homes sold locally last month was the lowest single month of sales in at least the past six years, dating back to January 2016, when 63 homes were sold. A year ago, January saw 115 homes sell, reflecting a 46% decrease in closed transactions during the same month year over year.

The median price of homes sold in January fell 6.8% — to $465,000 — from the $499,000 price recorded in December, and marked a 14.6% drop from the $545,000 median price of homes sold in January 2022.

The median days on market it took for a home to receive an accepted offer was 63 in January, an increase that likely included several homes that were sold after a significant stay on the market. On average in 2022, it took 21 days for sellers to receive an acceptable offer.

That’s clearly not the way western Nevada County’s home sales started in the past two years. But despite January typically being a slower month of sales due to winter weather and the holiday season cutting into time to tour homes, there were signs of life in the market by month’s end.

Pending sales picked up month-over-month with 25.3% more transactions — 99 — pending at the end of January than the 72 recorded pending in December. One year ago, in January 2022, there were 157 pending sales in western Nevada County.

Lagging inventory in recent months has meant fewer options for homebuyers, likely impacting the pace and volume of sales. There were 187 homes listed for sale in January, which was 20% fewer than December, but also 23.8% more than the 151 on the market in January 2022, the same month one year ago.

In the past week, 33 local homes were added to the Multiple Listing Service, including 13 new listings on Friday.

ACROSS THE STATE

Low inventory and rising interest rates are among the challenges home buyers have faced in recent months, as the California Association of Realtors noted in a news release discussing a statewide decrease of housing affordability this week.

“The percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California dipped to 17% in fourth-quarter 2022 from 18% in the third quarter of 2022 and was down from 25% in the fourth quarter of 2021,” the association reported. “California hit a peak high affordability index of 56% in the first quarter of 2012.”

Countywide, according to the association, 27% of buyers could afford to purchase a $526,000 median-priced home in Nevada County in the fourth quarter, which marked a 2% increase over the third quarter but significantly lower than the 37% who qualified in the fourth quarter of 2021.

The association’s county-by-county affordability index included a look at the monthly payment (taxes and insurance included) for a median priced home in Nevada County ($3,350) and the minimum qualifying income to purchase it ($134,000).

BY THE NUMBERS

January home sales in western Nevada County:

- $465,000 — Median price (2022)

- $545,000 — Median price (2021)

- 63 – Days on market (2022)

- 29 – Days on market (2021)

- 62 – Homes sold (2022)

- 115 – Homes sold (2021)

- 187 – Homes for sale (2022)

- 151 – Homes for sale (2021)

Brian Hamilton is a Realtor (DRE# 02149112) for the Betsy Hamilton Real Estate Team (DRE# 01936209) at RE/MAX Gold (DRE#: 01949144) in Grass Valley. For more information, contact him at Br***@Be***********.com.