Just as we’ve seen with the shift in western Nevada County’s real estate market, the rest of California — and the nation, for that matter — continued a downward shift through the month of June.

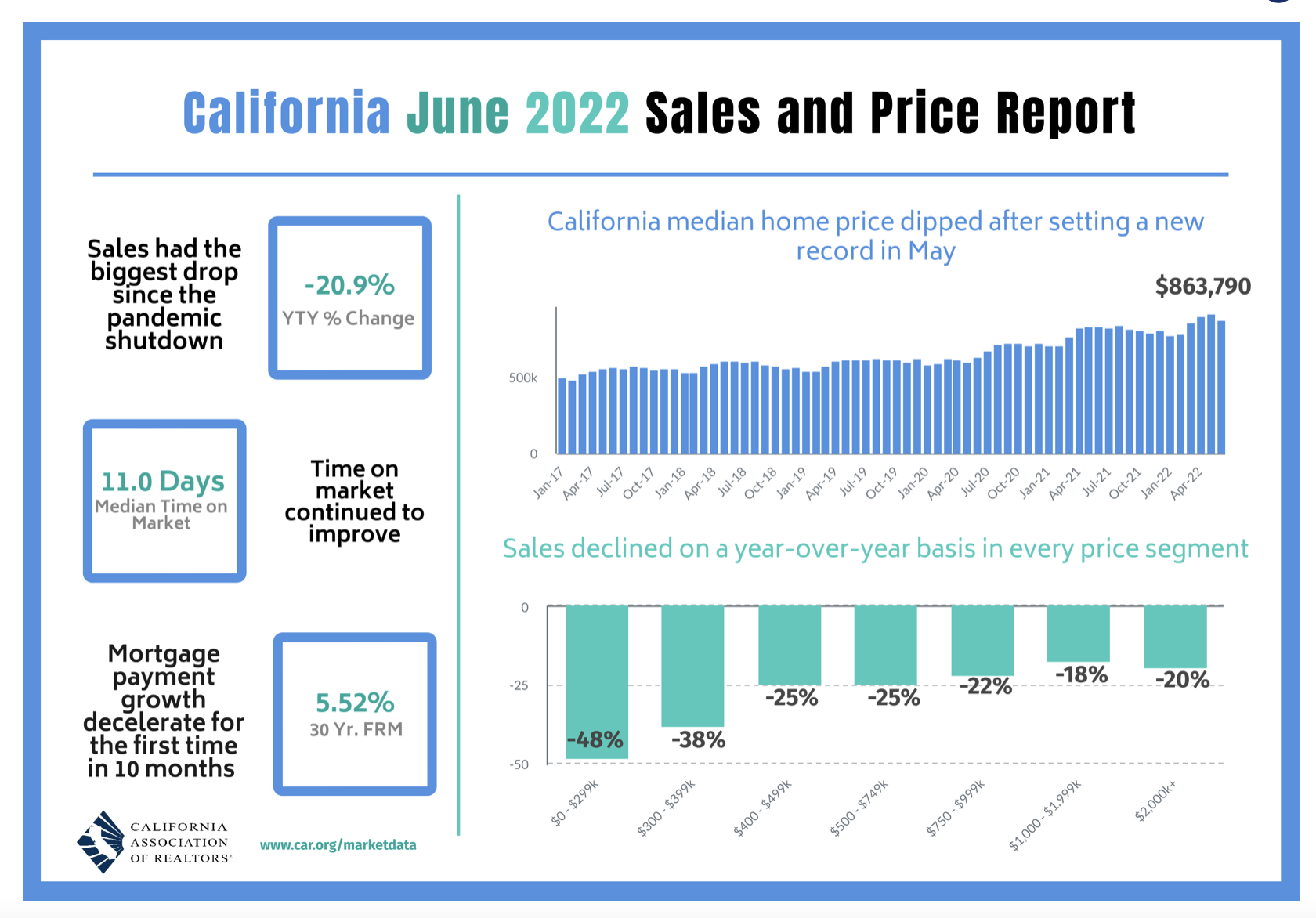

According to the California Association of Realtors June’s sales pace was down 8.4% on a monthly basis from May and down 20.9% from a year ago.

It’s been a similar shift nationally.

“Contract signings for home purchases, or deals signed but not yet closed, fell 8.6% in June from a month ago,” Axios reported. “That was well above what economists were predicting, and a 20% drop from last year.”

As we wrote last week, western Nevada County has seen 8.6% fewer homes sold in the first six months of the year than in 2021. Locally, there were 797 units sold in the first six months, down from 873 in 2021 but still ahead of 2020 (622) and 2019 (686) in sales.

June’s statewide median home price was, $863,790 down 4% percent from May and up 5.4% percent from June 2021.

In western Nevada County, June’s median price was $579,000.

“California’s housing market continues to moderate from the frenzied levels seen in the past two years, which is creating favorable conditions for buyers who lost offers or sat out during the fiercely competitive market,” said association President Otto Catrina.

“With interest rates moving sideways in recent weeks and fewer homes now selling above listing price, prospective buyers have the rare opportunity to see more listings coming onto the market and face less competition that could force them to engage in a bidding war.”

After increasing for four consecutive months, the share of million-dollar home sales dipped as sales in the higher-price segment dropped 8.3% from the prior month, the association reported.

“Excluding the three-month pandemic lockdown period in 2020, June’s sales level was the lowest since April 2008. Pending sales data also suggests we can expect additional retreating in the coming months,” said association Vice President and Chief Economist Jordan Levine. “With inflation remaining high and interest rates expected to climb further in the coming months, the market will normalize further in the second half of the year with softer sales and more moderate price growth.”