At long last, the Federal Reserve announced Wednesday it reduced its key interest rate by a larger than typical half-percentage point, the first reduction since the pandemic.

“The central bank is acting because, after imposing 11 rate hikes dating back to March 2022, it feels confident that inflation is finally mild enough that it can begin to ease the cost of borrowing,” the Associated Press reported Thursday. “At the same time, the Fed has grown more concerned about the health of the job market. Lower rates would help support the pace of hiring and keep unemployment down.”

The impact expects to extend into all aspects of borrowing, both by consumers and businesses, from auto loans to home mortgages to consolidation of debt.

“We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with this inflation. That’s what we’re trying to do, and I think you could take today’s action as a sign of our strong commitment to achieve that goal,” Federal Reserve Chair Jerome Powell said Wednesday.

The Fed’s benchmark rate doesn’t directly set or correspond to mortgage rates. But it does have a major indirect influence, and the two “tend to move in the same direction,”Jacob Channel, a senior economist at LendingTree, told the AP.

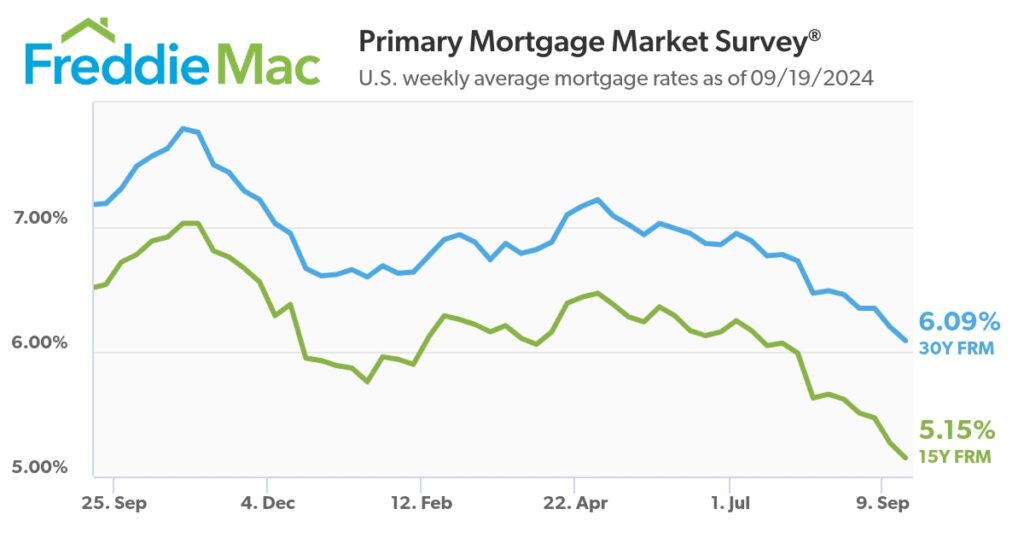

To that end, mortgage rates have already declined ahead of the Fed’s predicted cut.

“It goes to show that even when the Fed isn’t doing anything and just holding steady, mortgage rates can still move,” he said.

Channel said that the majority of Americans have mortgages at 5%, so rates may have to fall further before some consider refinancing.

According to Redfin, 88.5% of mortgaged U.S. homeowners have a rate below 6%, down from a record 92.8% in the second quarter of 2022. And 78.7% have a rate below 5% with 59.4% of homeowner owning a rate below 4%.

More Fed rate cuts are expected in the coming months, the AP reported, with the steepness of the reductions dependent on the direction of inflation and job growth.

“We know that it is time to recalibrate our (interest rate) policy to something that’s more appropriate given the progress on inflation,” Fed Chair Jerome Powell said at a news conference. “The labor market is actually in solid condition and our intention with our policy move today is to keep it there.”