We attended a valuable conference on Jan. 19. Jordan Levine who is the senior vice president and chief economist for the California Association of Realtors was actually in our area, so we got the info firsthand.

Here are some highlights from the conference. Consult your financial planner or lender to see how some of these ideas can fit into your investing and life goal plans:

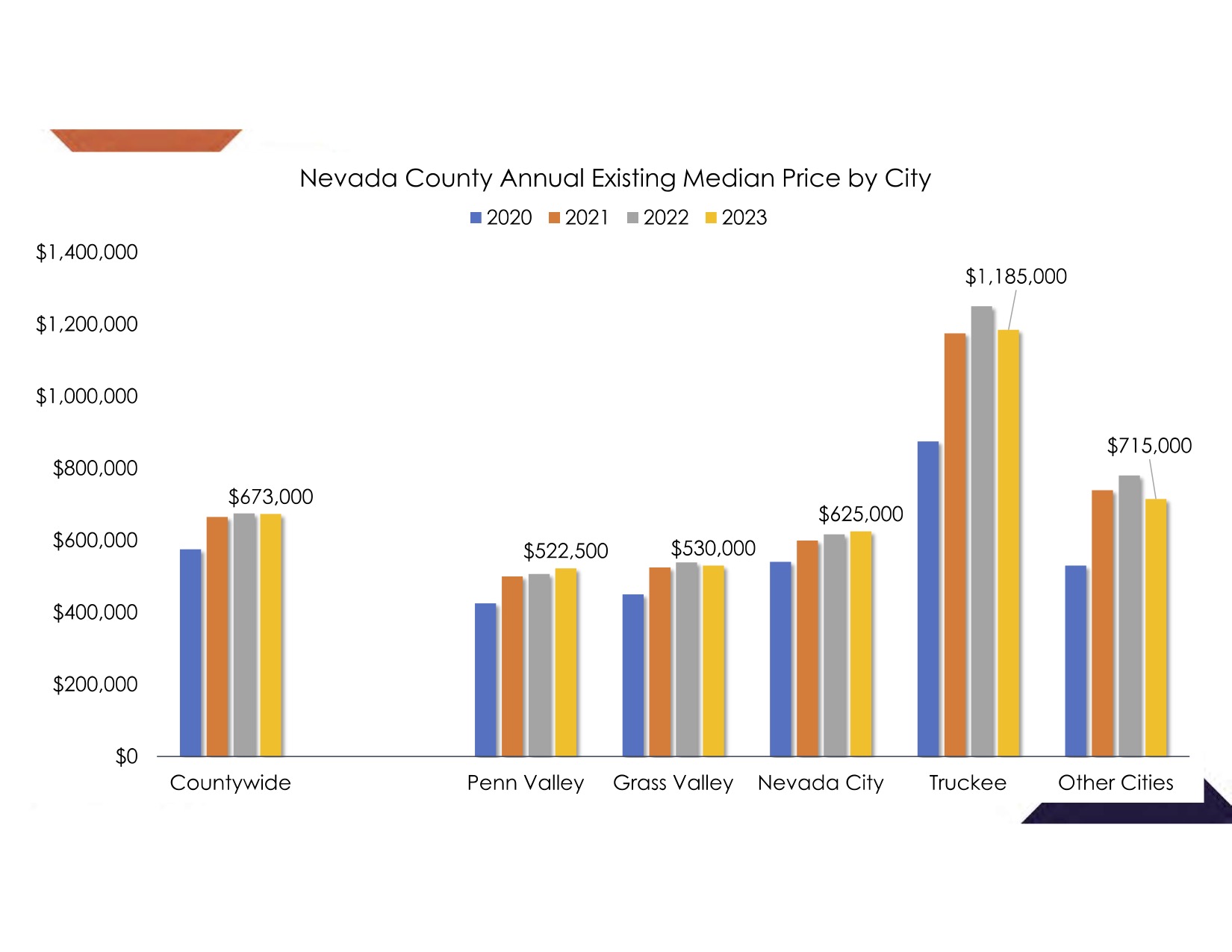

Home values are not expected to go down. Due to lack of inventory, they are expected to stay relatively the same or more possible, go up.

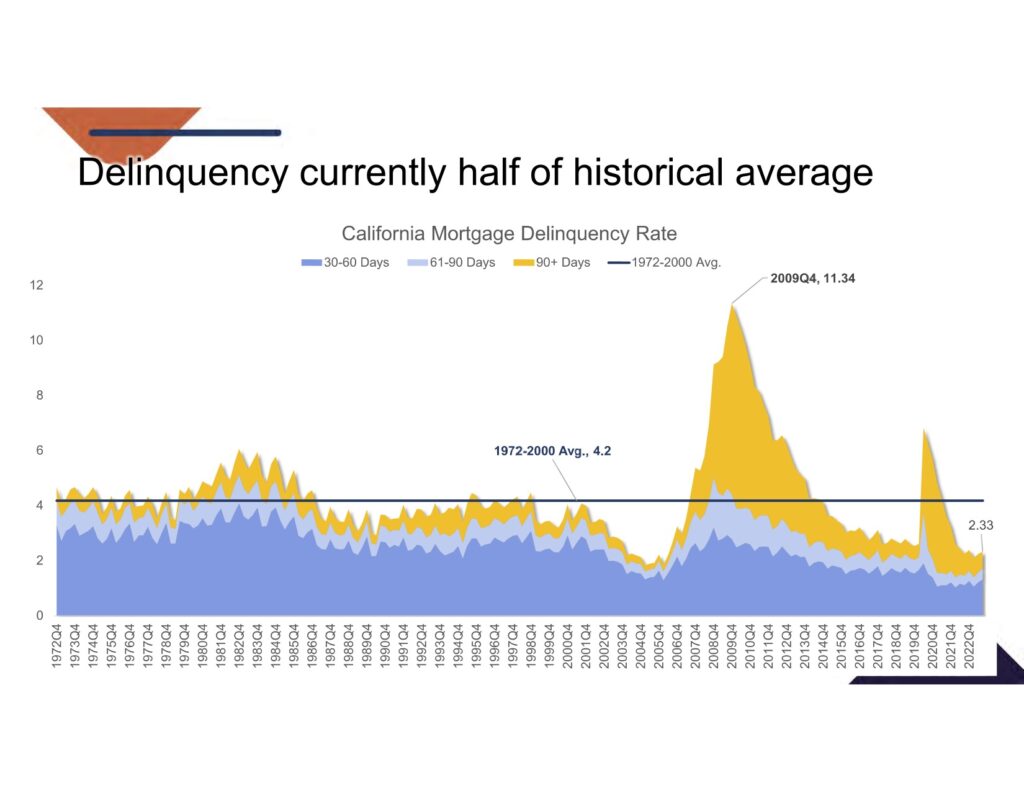

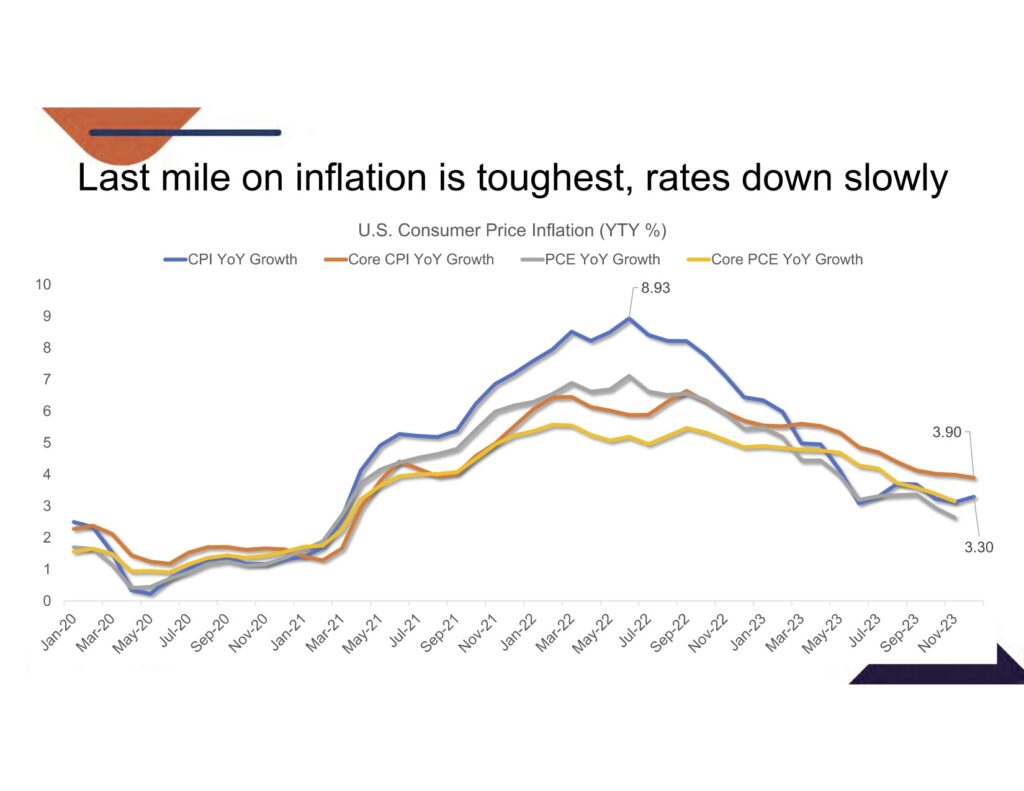

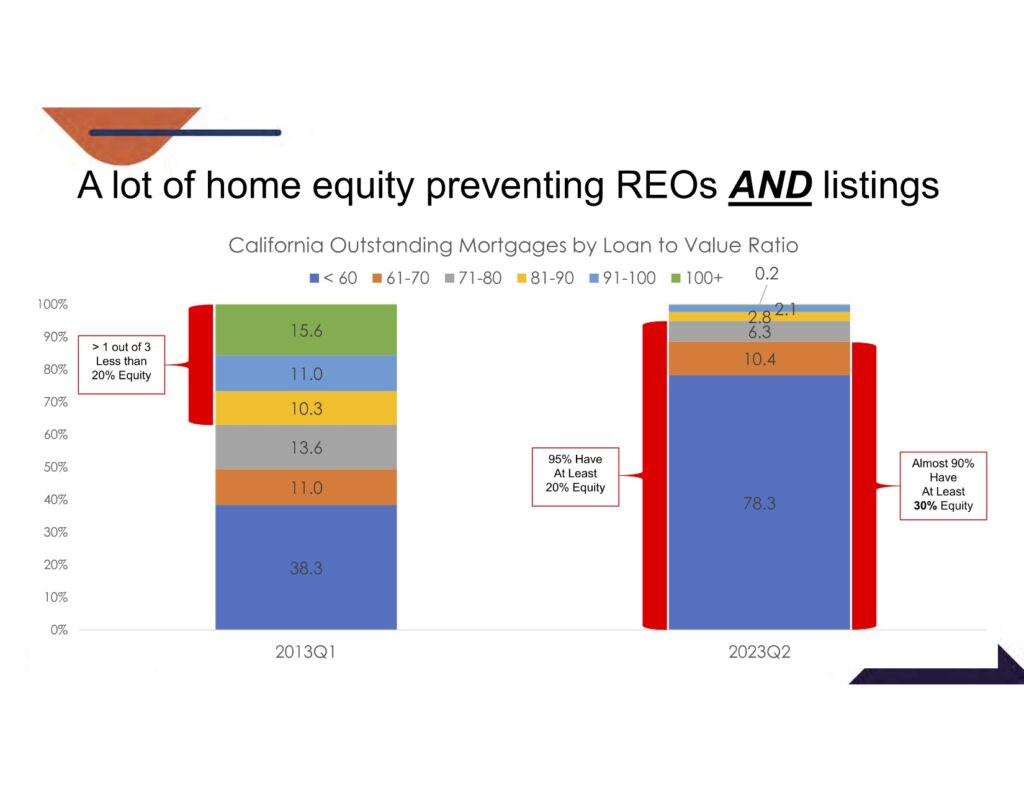

A slow descent of interest rates is projected, versus a rapid decline or steep drop off. However, circumstances in the economy could change that. Don’t count on rates dropping, and certainly not rapidly, because neither may happen.If you are waiting for foreclosures to pop up, it may be a long wait. Due to the immense amount of equity homeowners have, it is highly unlikely, unless someone has an unusual set of circumstances, that properties will go to foreclosure as they can easily be sold instead. In fact, 98% of mortgages are being paid on time. You can’t go back in time to accumulate equity you could have had by buying earlier. It’s a waste of time and equity waiting for the perfect house at the perfect interest rate. Real estate investing is a long-term game. The gains you could have had in equity could very well be erased by the time it will take for external forces to deliver the desired interest rate. A better play could be to buy when you find the perfect home, even at a higher than desired interest rate (assuming it’s still affordable for you), than to waste equity building time waiting for rates to float down. Refinancing later when rates adjust could be the better option versus waiting.

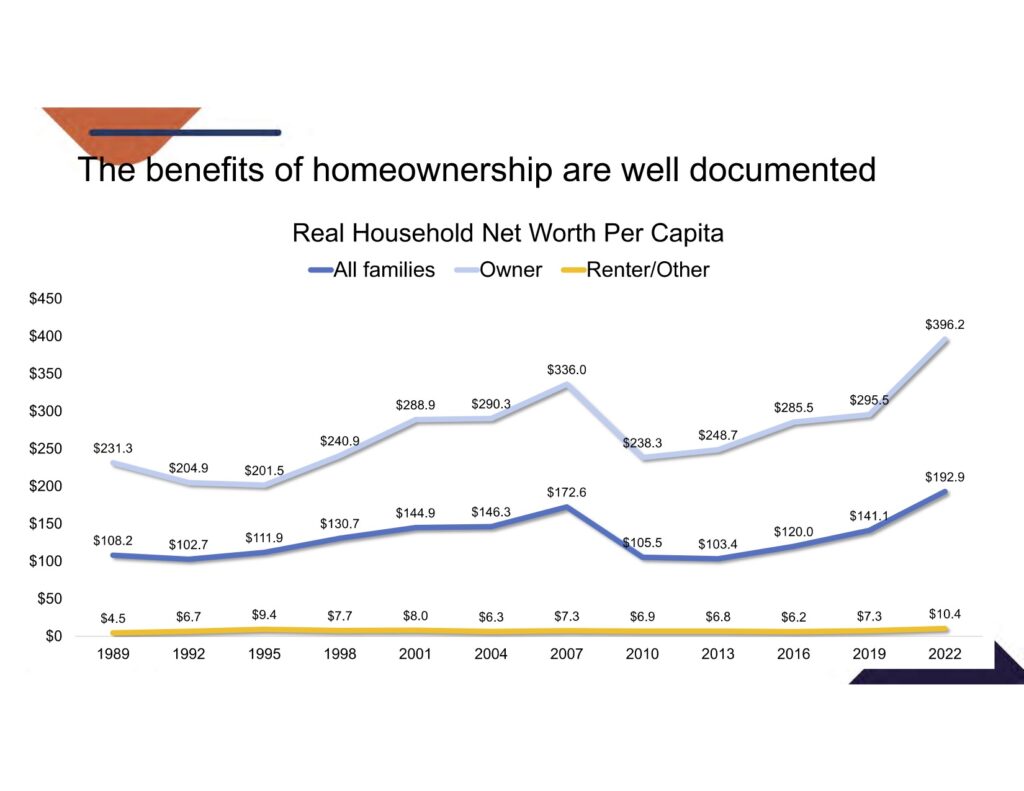

You can’t go back in time to accumulate equity you could have had by buying earlier. It’s a waste of time and equity waiting for the perfect house at the perfect interest rate. Real estate investing is a long-term game. The gains you could have had in equity could very well be erased by the time it will take for external forces to deliver the desired interest rate. A better play could be to buy when you find the perfect home, even at a higher than desired interest rate (assuming it’s still affordable for you), than to waste equity building time waiting for rates to float down. Refinancing later when rates adjust could be the better option versus waiting.

Homeowners have wealth building and generational abilities that renters never will.

Homeowners have wealth building and generational abilities that renters never will.

Buy at a payment you can afford now. When rates decrease in the future, it’s a windfall for you.

6% rates are normal and they have been for a long time. We became spoiled by artificially low rates which happened during the Covid years. We may never in our lifetime see those kinds of rates again, so waiting for them to reappear is not a great investment approach. If we normalize 6%, which we should, then mentally adjusting to reality will help buyers gauge affordability for themselves. Buy what is affordable now or in the near future if buyers are expecting a financial uptick. Make sure it’s affordable. as decreasing rates will take time.

Use the CAR Purchasing Power Calculator:https://www.car.org/en/marketdata/interactive/interestrateaffordability. You can tailor any scenario you wish to, in any county you wish to, and play around with a variety of scenarios. The target being affordability. You can use this calculator to find out what you are comfortable with in payment and then determine how much buying power you have, such as your purchase price comfort zone. General questions you may have had to ask a lender before can easily be determined by using this calculator. You can also see the inventory levels in that target price point to gauge how realistic that pricing is and what you can buy for it.

The difference in purchase power for higher-end buyers is very noticeable and the housing product is very different. Someone who is accustomed to living in a million-dollar home, for instance, at 3% rates, is now shopping in the $700K range due to purchasing power declines at today’s higher rates. The difference between a $700K home and a million-dollar home is quite different in terms of amenities, square footage, location etc. Because we don’t expect prices of homes to go down, some buyers will need to revisit what they really want and need — in order to purchase now and begin growing equity, or living the life they want to, where they want to, versus waiting.

90% of sellers have at least 30% equity in their homes.

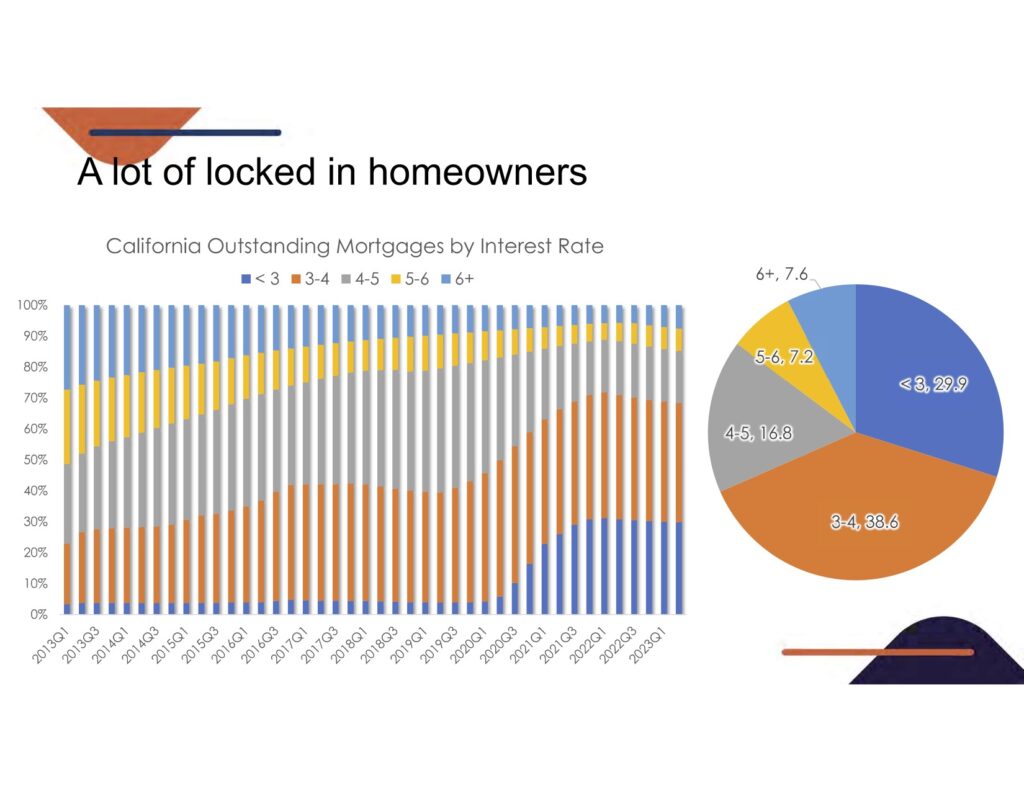

There are a lot of “locked-in” sellers. Two-thirds have rates below 4% with fixed-rate mortgages. To sell and buy now, they would have to get a new loan at 6% or more, which impacts sellers’ desire or ability to move. Herein lies the logjam in listings and, consequently, higher prices due to low inventory.

Inventory will stay tight for the foreseeable future which makes waiting for a better inventory, or better rates, not the best choice for many buyers.

Because buyers are price sensitive, sellers should price right at the very beginning versus a series of price reductions.

Sharon Currie is a Realtor (DRE #01357602) and operations manager for the Betsy Hamilton Real Estate Team. Contact her via email at sharon@betsyhamilton.com. Graphs and illustrations courtesy of the California Association of Realtors.