Homebuyers who have been waiting for interest rates to drop to get back in the market appear to have finally gotten their wish and, according to news reports, they’re now out touring homes once again.

With the next meeting of Federal Reserve about two weeks out, mortgage rates continue to recede and evidence suggests borrowers are reacting to more favorable housing market conditions, as HousingWire.com reported in a story this week.

“Lower rates have recently sparked more activity in the mortgage market. Attom, a nationwide property data provider, reported last week that the number of originations rose 23% between the first and second quarters of 2024, the first quarterly increase in a year. Purchase loan activity jumped by 33% and refinance activity increased by 10% during this period.

“A cautionary note is warranted, as we shouldn’t read too much into one great quarter,” Attom CEO Rob Barber said in a statement. ”A similar trend occurred last spring, with lending dropping off significantly later in the year. But with interest rates settling down and projections for more cuts from the Federal Reserve over the coming months, it wouldn’t be surprising if business increased even more for lenders over the rest of 2024, or at least didn’t drop significantly.”

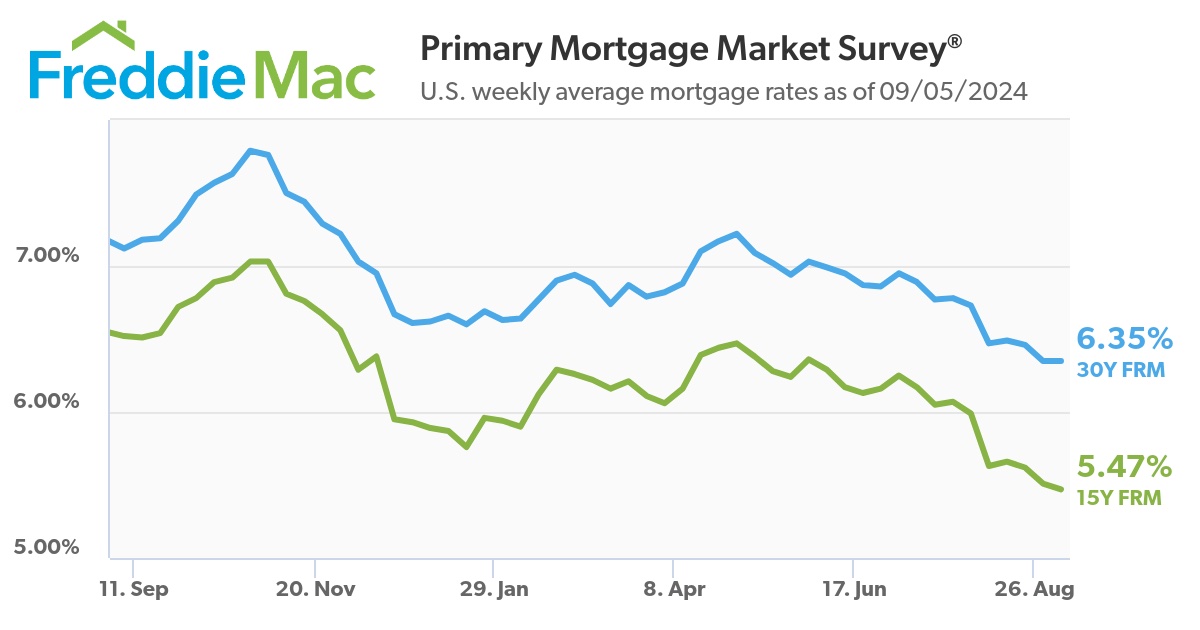

According to a Bankrate.com report, the average 30-year mortgage rate began falling from 7% in mid-July, and landed just under 6.5% as of late August.

Mortgage rates might not fall as precipitously this month, even with the likelihood of a Federal Reserve rate cut. With inflation cooler, the Fed is primed to cut rates at its next meeting ending Sept. 18 — the first reduction since the pandemic. While the Fed doesn’t directly set mortgage prices, it does influence them, and they’ve been trending down as cuts loom.

“Mortgage rates will trend lower in September, but it will be an uneven journey,” says Greg McBride, CFA, Bankrate’s chief financial analyst, said in the report. “Economic data, such as a weak jobs report, would spur more movement in mortgage rates than any response to a long-expected Fed interest rate cut.”

Rates fell last month in response to cooling economic data, including the most recent jobs report, which showed that the labor market slowed more than expected in July. This boosted market expectations that the Federal Reserve will start lowering the federal funds rate soon, Business Insider reported Monday.

“Later this week, we’ll get a look at how the labor market trended in August. Though the Fed is already expected to lower rates at its meeting later this month, this latest jobs report could raise the odds that central bankers will opt for a more aggressive half-point rate cut, as opposed to the typical quarter-point decrease.

“As the Fed lowers its benchmark rate, mortgage rates are likely to ease. But how much they go down depends on the timing and size of the Fed’s cuts, as well as the strength of the overall economy.”

MarketWatch.com reported Wednesday mortgage rates fell for fifth week in a row.

“That pushed the market composite index — a measure of mortgage application volume — up slightly in the past week, according to the Mortgage Bankers Association on Wednesday.”

“Homebuyers still face a very expensive market,” the report continued, “with record-high home prices dampening their interest. And current homeowners have little incentive to refinance, with nearly eight in 10 homeowners holding a mortgage with a rate of less than 5%, according to Redfin’s analysis.”